Property Tax Exemptions and Refunds

The purpose of special assessments is to fund specific local improvements and infrastructure projects. It is an additional tax levied on the owners of property in the area that would benefit from the project. These additional taxes are approved through voter ballot measures. The taxes are additional expenses added to the regular ad valorem taxes.

Request Property Tax Special Assessment Exemption

Property Owners may request exemptions from Special Assessments. When exemptions are granted, the Special Assessment tax may be decreased or removed in the following year for the approved exemption. If the taxes were already issued by the County of Alameda Assessor's Office, then an approved exemption will be paid via refund once the property taxes are fully paid by the property owner.

The types of exemptions offered by the City of Oakland:

- Low Income Homeowner

- Low Income Senior

- Non-Profit or Affordable Housing Parcels

- Religious Organizations

- Schools

- Multi-Unit Parcels with Vacant Units

- Undeveloped Vacant Lots

- Foreclosed Property where the Property Taxes were paid by the Tenants

Exemptions are available for other measures not handled by the SPARE team.

For more information:

Exemption Information

Low-Income is based on three factors: the owner is currently occupying the parcel, the number of people within the household, and total combined gross income for all household members. Please refer to the chart below. If your total household combined income is equal to or below the threshold per the chart below, download the SPARE Exemption Application(PDF, 324KB).

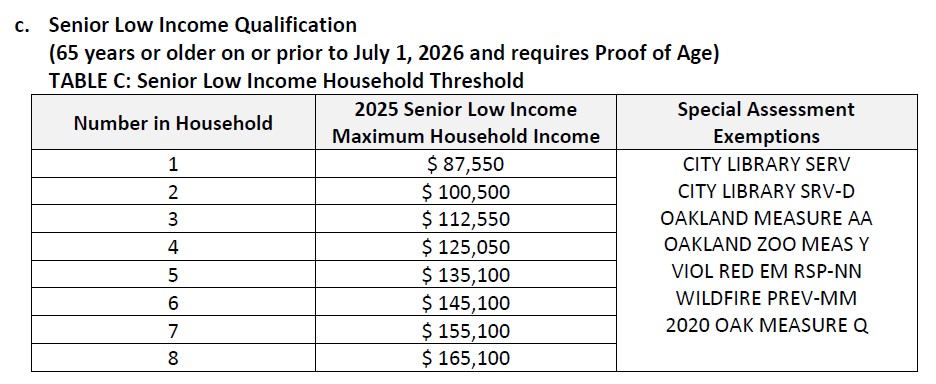

If any of the homeowners are 65 years or older as of July 1st of the appropriate tax year, the threshold for an exemption is higher to help our Senior community. Low-Income is based on three factors: the owner is currently occupying the parcel, number of people within the household, and total combined gross income for all household members. Please refer to the chart below. If your total household combined income is equal to or below the threshold per the chart below, download the SPARE Exemption Application.

Non-Profit or Affordable Housing Parcels may be eligible for various exemptions. The requirements are a current and paid Oakland Business License and a full or partial exemption from Ad Valorem taxes. The Claim for Welfare Exemption from the County of Alameda may be submitted as proof of exemption. The Exemption will apply based on the appropriate ballot measure language. Download the SPARE Non-Profit or Affordable Housing Exemption Application(PDF, 153KB).

Religious owned parcels may be eligible for exemption. Two conditions must be met. First, the owner of parcel must be a religious organization. Owners that are individuals or for-profit organizations may be ineligible. Second, the parcel must have a full or partial exemption from Ad Valorem taxes and show ownership to a religious organization. The County Claim for Welfare Exemption, County Church exemption paperwork, and/or Religious Institution documentation may be requested for verification of eligibility. The Exemption will apply based on the appropriate ballot measure language. Download the SPARE School or Religious Exemption Application(PDF, 187KB).

School owned parcels may be eligible for exemption. Two conditions must be met. First, the owner of the parcel must be an educational organization. Owners that are not educational institutions are not eligible and will be denied. Second, the parcel must have a full or partial exemption from Ad Valorem taxes by the County of Alameda. The Claim for Welfare Exemption and/or Educational Institution documentation will be requested for verification of eligibility. The Exemptions will apply based on the appropriate ballot measure language. Download the SPARE School or Religious Exemption Application(PDF, 187KB).

A Multi-Unit Parcel is a residential parcel with five or more units. For Multi-Unit Parcels, the Special Assessment may be applied to each individual unit. These exemptions vary from measure to measure. A tenant list with occupancy dates will be typically requested as proof of vacancy.

Download the Multi-Unit Exemption Application(PDF, 148KB).

An Undeveloped Parcel is a parcel that has not had any development or structures on them. Parcels with fire damage may qualify if significant reconstruction is needed. Proof that the lot is undeveloped is required, typically photographs.

If you seek exemption for a Vacant Property charge, typically $3,000 or $6,000, please contact VPT. The contact information may be found on the Vacant Property Tax's website: Vacant Property Tax (VPT)

If a property has been foreclosed, and the Tenants of the property paid for all or a portion of the property taxes, an exemption may be available for those tenants in the form of a refund. To determine eligibility, please email spare@oaklandca.gov with the relevant details. A representative will help determine any potential eligibility

Special Assessment Refund and Exemption Forms (SPARE)

English

Spanish

Chinese

What Special Assessments may be exempted by the SPARE Office?

The SPARE office may determine exemptions for the Measures listed below. Click on the Measure to download the ballot measure documentation.

Do I need to Apply for the Exemption or Refund Every Year?

Low-Income and Low-Income Senior applications and must be sent every year. Income levels typically change from year to year. The documents must be audited to determine eligibility.

Non-Profit or Affordable Housing applications must be sent every year. This is required to ensure the business licenses are current and any documentation with the County of Alameda has been filed.

Religious Organizations and Schools may not need to apply each year. Once we determine eligibility, we will automatically review the prior year's approved applications for Religious and School institutions. The City requires application from new or previously denied parcels. The SPARE office will send a letter confirming or denying the exemption. If your organization does not receive that letter before May 1st, please contact our office as there may be an issue with the parcel.

How do I Check the Status of my Exemption or Refund Application?

At this time, the only way to check on the status is to call the SPARE team at (510) 238-2942 or email spare@oaklandca.gov

Someone will get back to you with the status.

We send a written letter once an application is approved or denied as official notice.

How do I Return My Exemption Form?

Mail the form and documentation to:

SPARE

150 Frank H. Ogawa Plaza

Suite 5342

Oakland, CA 94612

E-mail the application to: spare@oaklandca.gov

Bring the application to the drop box in the lobby of: 150 Frank H. Ogawa Plaza, Oakland, CA 94612.

Current Office Hours may be found on the Finance Department Webpage.

What is the Deadline to File for an Exemption?

Applications are due by May 15th or the first business day thereafter. Submitting the application before this date will allow the City enough time to review your application. If you submit by this deadline and are determined to be eligible for exemption(s), the City can request the taxes be removed before the property tax bill is sent. The taxpayer will not see the charge on the bill, nor will the taxpayer have to pay any exempted measures. This is an "Early Exemption."

Applications for exemptions sent after the May 15th will still be accepted; however, applications must be received within one (1) year of the final tax payment date. If the application is determined to be eligible for exemption, the City will request a refund check to be mailed to the taxpayer with the appropriate amount of exemption after the taxes are fully paid. Example: If the second property tax installment was paid April 4, 2023, the parcel owner would have until April 4, 2024 to submit an application for exemption.

Additional Documentation Requests

Applications are required to have all supporting documentation at the time the application is submitted. Applications without all information will be denied.

The SPARE office may make a request for missing information via email, phone, or hard copy letter. The missing documentation will be noted on the letter.

A new application may be submitted with the requested documentation.

What if I do not file taxes?

If you are a homeowner that is not required to file taxes, the SPARE office still requires income information. While you may not have any taxable burden, government assistance programs evaluate gross income instead of taxable income.

The SPARE office may request documents such as but is not limited to: a copy of your Social Security Benefits letter, Annuity benefits letter, insurance payments, or a copy of your bank statement.

For all Homeowner low income applications, a No-Income Affidavit(PDF, 100KB) is required for any household member that does not receive any income in a given tax year.

Who Needs to Submit No-Income Affidavits?

For all Homeowner low income applications, a No-Income Affidavit(PDF, 100KB) is required for any household member that does not receive any income in a given tax year.

If a household member is both age 26 or younger and listed as a dependent on the homeowner's submitted tax return, the No-Income Affidavit(PDF, 100KB) is not required.

How long does it take to receive a refund?

A refund is only issued once the property taxes are completely paid. The check can take up to six (6) months to be issued once the property taxes are paid. For faster service, please call or email the SPARE office when the property taxes are completely paid.

How are Special Assessments Billed?

The County of Alameda calculates the Special Assessment per the voter approved Ballot Measure. The taxpayer pays the property tax to the County of Alameda. The assessments are listed as a separate line item on the property tax statement and must be paid together with your property taxes.

How are the Low-Income Levels Determined?

The Department of U.S. Housing and Urban Development publishes the median income for a family of four based on the median income for a geographic area. The City uses the same methodology to determine the Low Income thresholds. More information can be found at: https://www.huduser.gov/portal/datasets/il.html

What if I believe the Property Tax was calculated incorrectly?

If the taxpayer believes the Special Assessment was calculated incorrectly, the most current ballot measure or amendment must be reviewed for the calculation methodology. In many cases for a residential homeowner, it's a flat rate. In the case of commercial properties, the County of Alameda parcel map is typically used to calculate the Special Assessment. For any more specific information for the Special Assessment, please call the number listed on the line items with the Special Assessment tax.

If the taxpayer disagrees with a charge in the assessed value as shown on the Tax Computation Worksheet or Tax-Rate Breakdown of the Ad Valorem taxes, the taxpayer has the right to an informal assessment review by contacting the Assessor's Office at (510) 272-3787.

How do I contact the Spare office with any additional questions?

Email us at: spare@oaklandca.gov

Call us at: (510) 238-2942

Visit us in person at: 150 Frank H Ogawa Plaza, Suite 5342, Oakland CA 94612

Current Hours may be found on the Finance webpage.