The Progressive Business Tax proposal by Councilmembers Bas and Fife would reform the current flat-rate business tax in Oakland, which requires small businesses to pay the same tax rate as large corporations earning tens of millions in gross receipts.

This status quo is highly inequitable, with Oakland’s smallest businesses disproportionately bearing the burden of taxation.

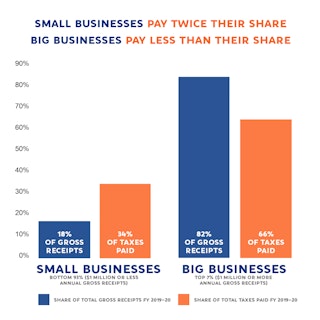

93% of all Oakland businesses earn less than $1 million in gross receipts annually. However, while their combined revenue comprises only 18% of taxable gross receipts citywide, together they paid double their share – 34% – of all business taxes in FY 2019-2020. This inequity is further demonstrated by the fact that the remaining 7% of businesses in Oakland – those earning more than $1 million in annual gross receipts – comprise 82% of gross receipts citywide, yet paid far less than their share, only 66% of total business taxes.

This progressive business tax proposal would increase fairness and equity by updating the tax to a tiered-rate structure, where smaller businesses pay less taxes, while larger businesses – especially the largest multi-million dollar corporations – pay more. The proposal would not increase taxes paid by homeowners and renters.

97% of Oakland businesses will see their taxes stay the same or go down. Over 20,000 small businesses – 39% of all businesses in Oakland — will receive a tax cut. Only the top 3% of the largest businesses in Oakland will see tax increases. These businesses collectively earn billions in revenue each year and their profits have skyrocketed during the pandemic.