The Opportunity Zones are meant to spur economic development and job creation in distressed communities by providing tax benefits to investors. Investors receive capital-gains tax deferral, reduction in basis for long-term investments and other tax incentives. Investments made by individuals through Qualified Opportunity Funds in these zones would be allowed to defer or eliminate Federal taxes on capital gains. You can get the tax benefits, even if you don’t live, work or have a business in an Opportunity Zone. Investments are not administered or overseen by the City of Oakland.

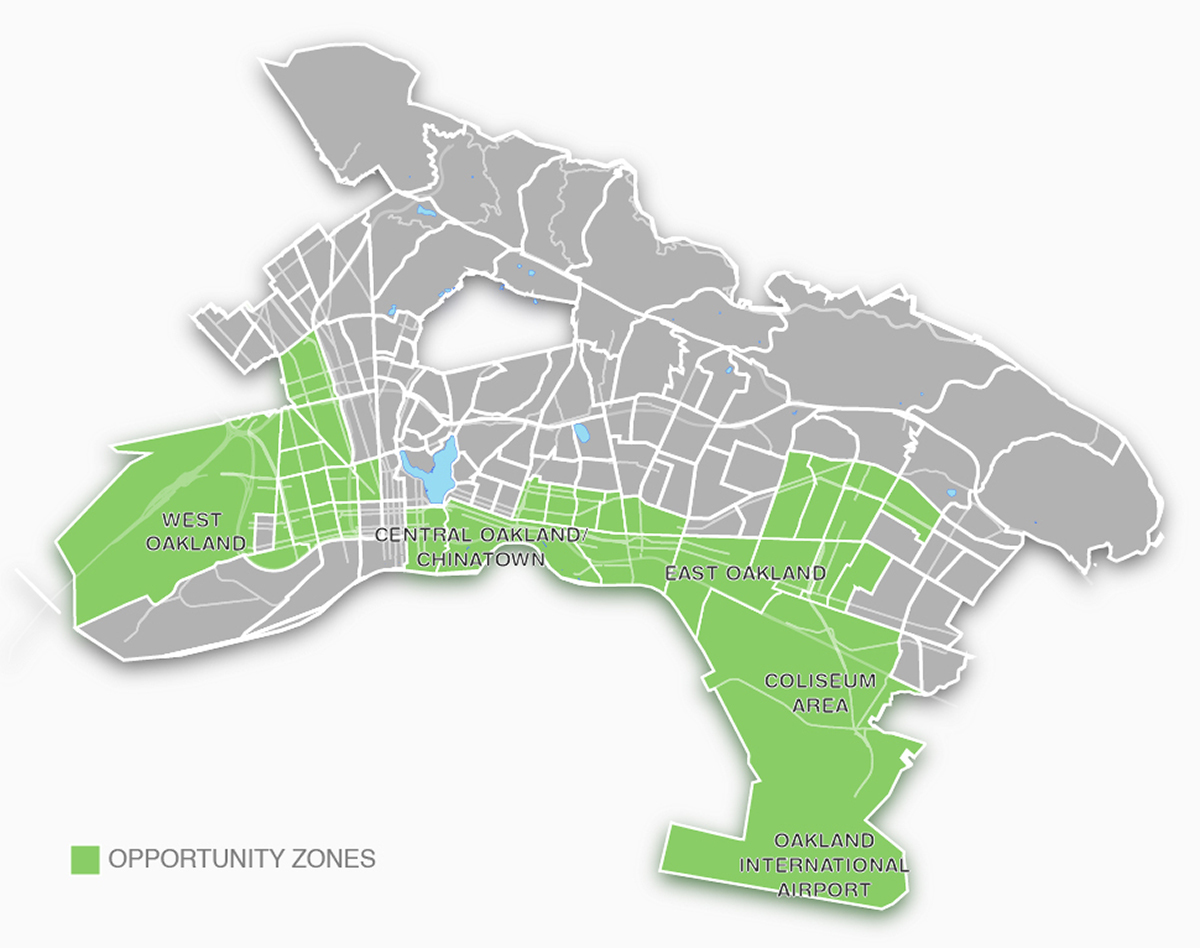

In Oakland, 30 census tracts were designated by Governor Jerry Brown as qualified Opportunity Zones for the next 10 years, through 2026.