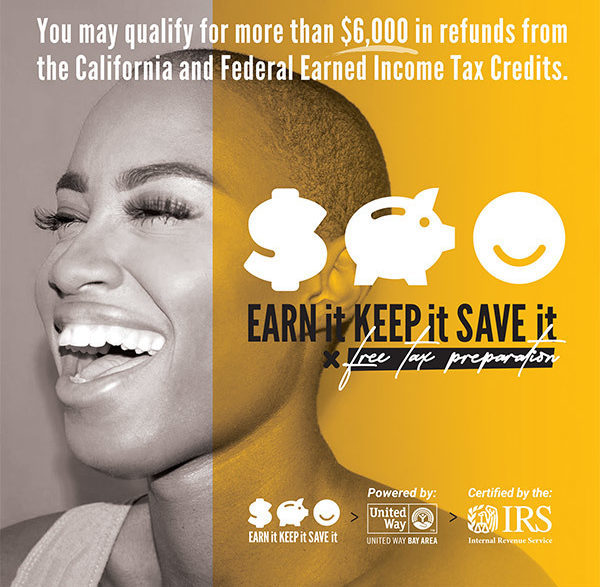

Get Your Taxes Done Fast and No Cost to You: The Alameda County – Oakland Community Action Partnership (AC-OCAP) in the Human Services Department, is pleased to inform our community that the City of Oakland’s Tax Assistance site located at 270 Frank H. Ogawa Plaza in the Business Assistance Center will once again be providing no cost tax preparation assistance. That’s right, if your household earned income was $56,000 or less in 2019, you can take advantage of this free benefit and get your taxes prepared by Certified IRS volunteers. Save your money in tax preparation fees and schedule your drop-off appointment today to see if you qualify for the federal Earned Income Tax Credit (EITC), the state CalEITC, and the new Young Child Tax Credit (YCTC) that provides qualifying families with a child under the age of 6 with up to a $1,000. Depending on your family size and income, you may qualify to receive a tax credit check of up to $6,000!

The Alameda County - Oakland Community Action Partnership (AC-OCAP) sponsored site will reopen by appointment only on July 1, 2020. Call the city’s EITC hotline at 510-238-4911 to schedule your no cost to you appointment.

Resources:

IRS FILE FREE https://apps.irs.gov/app/freeFile/

EARN it KEEP it SAVE it https://earnitkeepitsaveit.org/

Franchise Tax Board https://www.ftb.ca.gov/file/ways-to-file/index.html

Credit Karma | TAX https://www.creditkarma.com/tax/

Eden I&R Call 2-1-1 or Text 898-211